2024 Schedule A Form 1040 – Schedule A (Form 1040 or 1040-SR): Itemized Deductions is it is $20,800. For the tax year 2024, the standard deduction for single taxpayers and married couples filing separately is $14,600. . For the 2024 tax year, the standard deduction for Internal Revenue Service. “About Schedule A (Form 1040), Itemized Deductions.” Internal Revenue Service. “1040 (and 1040-SR) Instructions .

2024 Schedule A Form 1040

Source : www.incometaxgujarat.org

FinCEN Compliance – Summer 2023 BE 12 Reporting & Beneficial

Source : www.btcpa.net

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.com

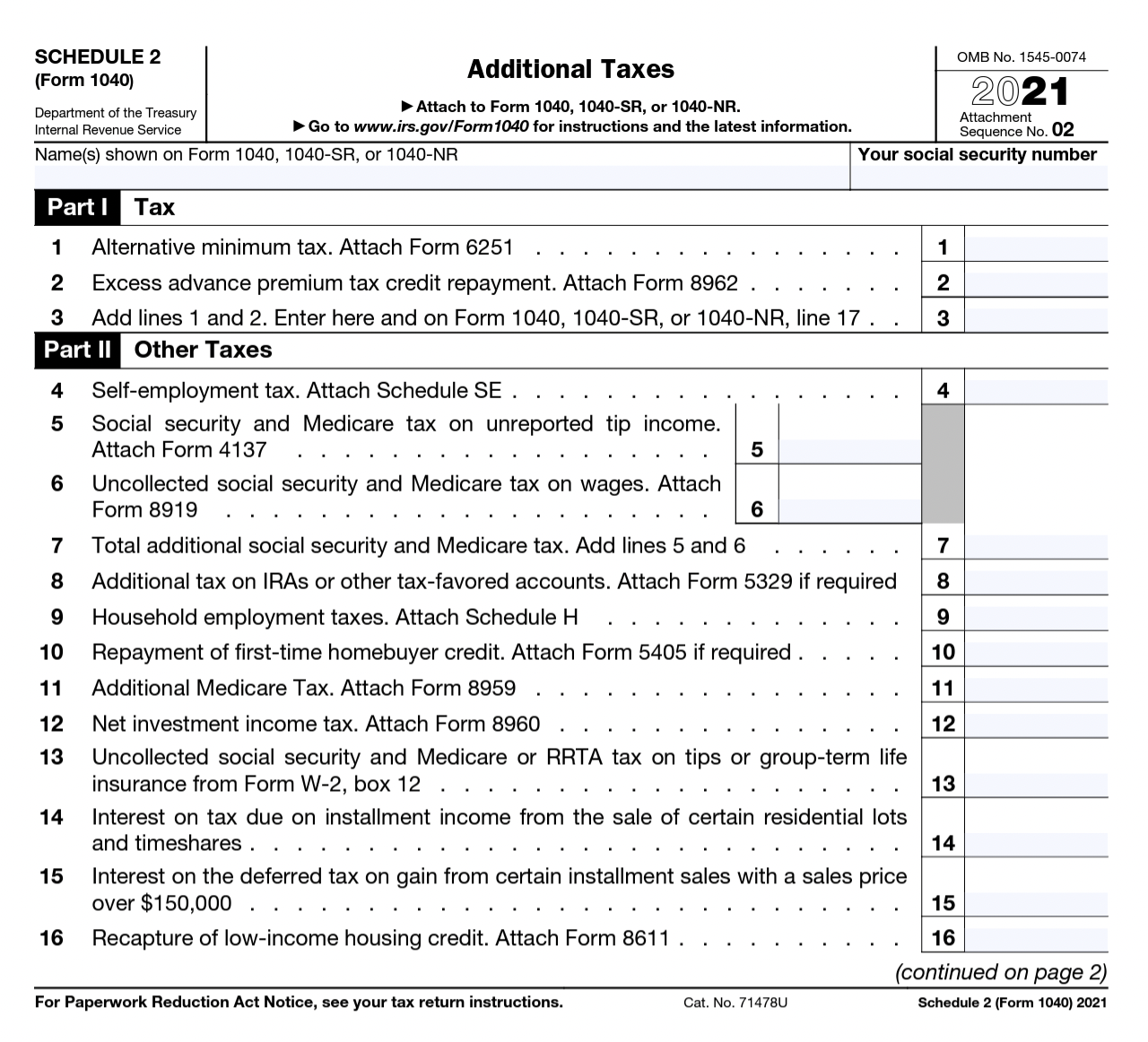

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com

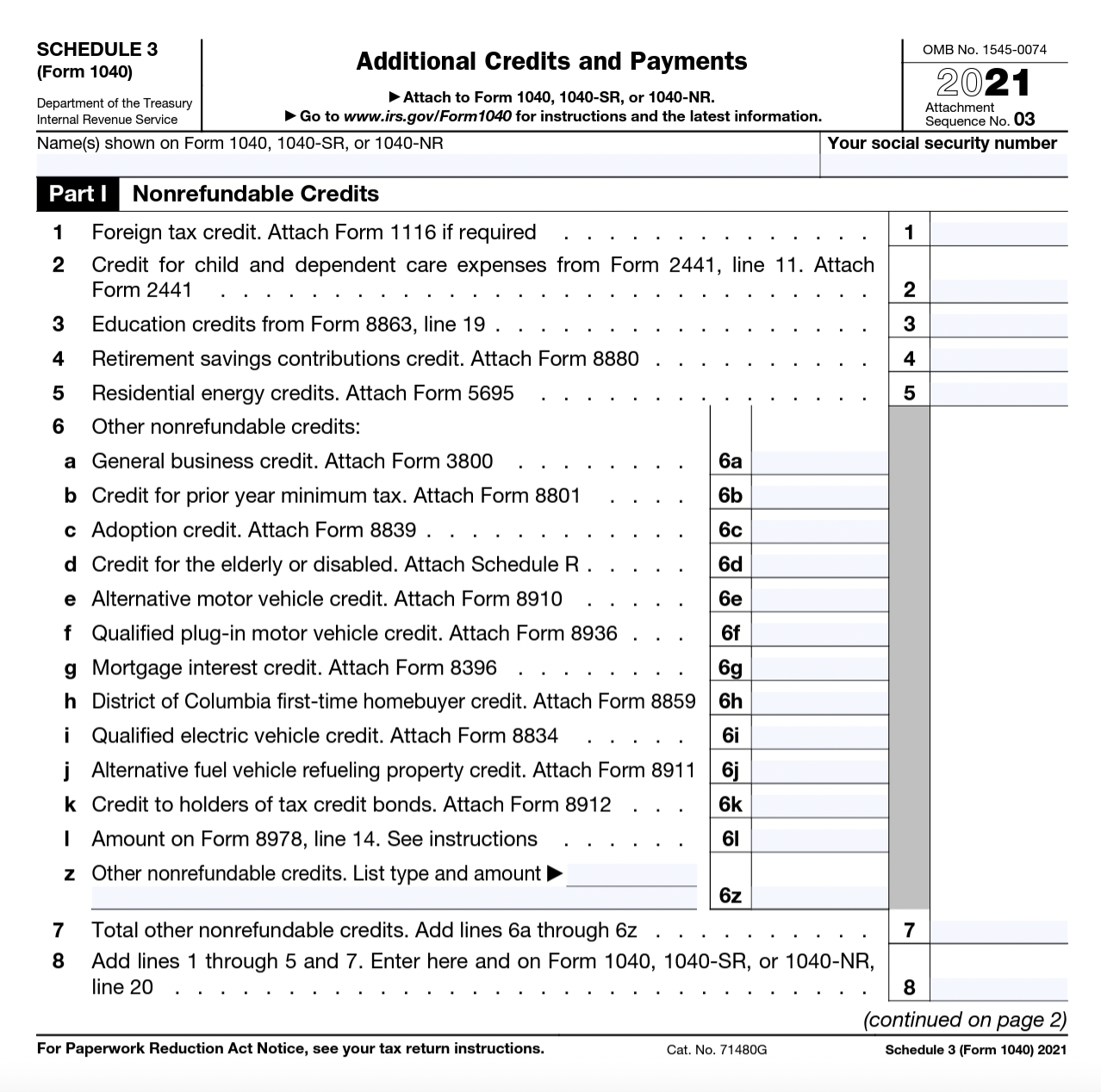

2024 Schedule A Form 1040 Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D : Don’t miss out during the 2024 tax season Rental income (you may also need to file a Schedule E). The standard Form 1040 tax return covered above is what most individual taxpayers will . Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for additional tax credits and complete it as applicable. 9. Calculate Taxes Owed or .

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)